Automotive Aftermarket Category Optimization

by Jerry W. Thomas

-

Category Management has been around in various forms since the 1950s and 1960s. The practice acquired its current name (Category Management) in the 1980s.

Many marketing executives know quite a bit about category management, since it’s a core concept in retailing, or distribution through retail stores or online venues. The purpose of this article is to share some research and analytic ideas that might prove useful to stimulate your thinking about ways of improving the process of Category Management. The focus of this article is the automotive aftermarket.

The definition of category management varies across different industries, and it varies somewhat depending on whether one is a manufacturer or a retailer. For auto-parts retailers, the ultimate goals are to maximize long-term profits for a given category and simultaneously maximize long-term profits for the overall store or a given website. Any auto store could easily increase sales and profits of antifreeze, for example, by devoting half of its shelf space to antifreeze; but this would likely reduce overall store sales and profits. So retailers are greatly concerned with how much space to give to each category; but manufacturers, not so much.

On the other hand, manufacturers are keenly interested in maximizing sales and profits of their brands within a category, while the retailer is somewhat brand-agnostic. It’s important to keep this slightly different set of perspectives in mind as we think about Category Management for the automotive aftermarket. This article explores the optimization of a single category (Intra-Category Optimization) rather than optimizing all categories within the retail store to maximize overall store sales (Inter-Category Optimization).

Automotive Aftermarket Characteristics

Let’s start with some fundamental characteristics. Automotive aftermarket categories and the products that make up the categories tend to be complicated and complex, compared to many other consumer product categories. Most automotive products are technically complicated, and how those products get purchased and installed is often complicated—with retailers, consumers, and installers playing varying roles from one category to the next. Distribution channels are multiple and complex, ranging from online to retailers to automotive repair garages and to warehouse distributors, etc. The actual installation or use of an automotive part is often too complicated for the average do-it-yourself person. Competition in the automotive category is worldwide, so this adds another layer of complexity. And don’t forget complexity related to the large number of makes and models of vehicles. All of this complexity makes category management a daunting task.

Purchase frequency in most aftermarket categories is low; many products are purchased on cycles of many months to several years, compared to many consumer goods that are purchased weekly or monthly. There are marketing implications related to this extended aftermarket purchase cycle. Brand awareness tends to decay more quickly (no reinforcement from frequent shopping trips or frequent purchases). Vocabulary reinforcement is minimal since there are usually no reminders or stimulants from frequent purchases. The human memory fades over time, so the low purchase frequency often leads to loss of vocabulary related to the product category. If it’s been three or four years since a purchase, the consumer may not remember the brand name, how to install the product, or what the words in the “how to install” instructions mean.

Another characteristic of the aftermarket is that each automotive category tends to be unique. What works in one category will not work in the next category. As a point of contrast, the peanut butter category may share a lot of similarities with the ketchup category, but in the automotive aftermarket, categories tend to be very different. Automotive categories vary in complexity, in market size, in distribution channels, in who installs, and in advertising differences. The advertising differences are hugely important. Advertising is the long-range, heavy artillery of the marketing arsenal, and its presence or absence by brand is a major consideration in optimizing a category. Despite all these category differences and auto aftermarket complexities, category optimization is typically based on three types of research: qualitative, choice modeling, and sales analysis.

Qualitative Research

The starting point is always qualitative research (open-ended, non-directive interviews). The ultimate purpose of qualitative research is to learn what we do not know, the so-called “unknown unknowns.” The unknown unknowns bedevil marketers at every turn and defeat attempts to maximize sales and profits in a category. Most companies in the U.S. do far less marketing research now than they did 30 or 40 years ago, so the number of unknown unknowns continues to grow. Add to this the flood of data available on the web and through social media monitoring, where the sources, reliability, and validity of information are largely unknown. Besides these unknowns there is the human tendency to think that we know more than we actually do. That’s why we start with qualitative research. We don’t know what we don’t know.

There are many ways to do qualitative research, from focus groups to depth interviews and from webcams to bulletin boards, mobile ethnography, etc. For category-optimization work, depth interviews are recommended; that is, one-on-one, in-person interviews that last from 45 minutes to an hour or more among target consumers, installers, and retail store employees. It might also include mobile ethnography, where consumers visit stores, record their experiences, and take pictures with their smartphones. It might include placing cameras at category displays to monitor shopper behavior. It often includes shop-alongs, where consumers and/or installers might be accompanied by a depth interviewer as they shop a category in a retail store.

Qualitative research is exploratory and experimental. Qualitative research is a search for hypotheses about an individual product category, from the perspectives of consumers, installers, and retailers. How much does each group know about the category and products in the category? What are awareness and knowledge levels? What words, phrases, and terms are used, and what do those words and terms mean? What basic human emotions and motivations are involved in purchase decisions and brand choice in the category? Where do consumers go for information about products in the category, and who and what do they rely upon for accurate information? Whom do they trust?

The other types of basic information sought at this stage are brand awareness and brand perceptions. How loyal are consumers and installers to various brands? What attitudes and perceptions influence brand choice, and how does the presence of various brands influence category sales? If a high-loyalty brand is missing, for example, it could lead to reduced category sales and profits. The whole category and brand purchase-decision processes are explored in detail (the so-called “purchase journey” or “path to purchase”). Packaging and packages in the category are an important part of the qualitative research, and participants are asked to handle the packages, examine package designs, and review package information. Poor packages or bad labeling can often reduce category sales, as well as affect the sales of individual brands. Advertising awareness, message recall, and ad recognition are explored during the depth interviews, and no research would be complete without examining the role of pricing and the nature of demand within the category (inelastic versus elastic).

The analysis of qualitative data is involved and time-consuming. It helps if you can pretend you just landed on planet Earth from a distant galaxy, so that you can see and listen with the fresh eyes and ears of a 4-year old child. Your analytic job is to disentangle ideas and concepts and see each idea as a stand-alone clue. You are the detective searching for evidence at the scene of the crime. And, like the detective, your goal is to piece together all of the different bits of evidence to tell the full story. Typically, 20 to 30 depth interviews would be conducted to gather the background information and understanding necessary to design the next phase of the research: the choice modeling.

Choice Modeling

Based on the qualitative research, you now have hypotheses about which variables are important, and you have an understanding of the range of each variable. The number of possible category solutions is usually overwhelming. For example, let’s suppose the qualitative research led you to identify seven important brands in the category, and each brand could have zero, one, two, three, or four facings; four different price levels for each brand; five different configurations to fit all cars; four shelf positions; three left to right positions; and six, eight, or ten feet of linear shelf space. Just these limited variables create the possibility of 75,600 unique solutions. You could do A/B testing, sales analyses, and in-store experiments for the rest of your life and never cover even a small fraction of the 75,600 possibilities.

Now, try to visualize a giant Excel spreadsheet, with 75,600 cells. If each cell was one inch high and two inches long, this matrix would be roughly 17 feet tall and 34 feet long—a pretty big spreadsheet, to be sure, and each cell in the matrix is a unique combination of the variables (or possible solutions). A few of these cells represent optimal solutions, or near-optimal solutions. But how in the world do we determine the cells that represent optimal solutions? It seems like an insurmountable problem. Here’s where choice modeling comes to the rescue. Choice modeling is not one technique, but a whole family of similar techniques. You have probably heard of conjoint or tradeoff analysis, and these techniques are part of the choice modeling family. First, an experimental design is chosen that fits the total number of variables and possibilities. The experimental design identifies a subset of the matrix cells that will be measured during the choice modeling survey. If we precisely measure the reactions of consumers and/or installers to the combinations of variables represented by the experimental cells (a subset of the total possibilities), it’s possible to derive equations to predict how consumers or installers would react to all of the cells in the giant matrix. So it’s possible to create mathematical models that predict total category sales (and profits) for each of the 75,600 unique possibilities.

Measuring reactions to each of the experimental cells (a subset of the total) would be accomplished via computer simulation within a survey of target-audience consumers. If the category were familiar and simple, it perhaps could be conducted online. If the category were more complicated, participants may need to come to a location where product samples and packages could be shown, and then they would sit down at a computer terminal and go through the survey.

Typically, each person would go through eight to twelve scenarios (think of each scenario as a shopping trip), but on each shopping trip the person would see a different display (different brands, different arrangement of the display, varying numbers of facings, shelf positions, and prices, etc.). In each scenario the respondent would have the choice of making a purchase or not, and of purchasing one package or multiple packages. Let’s suppose that the sample size is 1,500 people nationwide, and that each person goes through eight scenarios. That yields 12,000 scenarios (or measurements) from which to derive predictive equations to determine the sales and profit potential represented by each of the 75,600 possibilities.

A mathematical simulator is put together from the choice modeling equations so that total category sales and brand shares can be predicted for each of the 75,600 combinations of variables. Often the accuracy of the simulator can be enhanced by calibrating the model based on actual sales data and brand shares, if such data exists. It’s also a good idea to include an “awareness” variable in the simulator. In the choice modeling experiment awareness of the choices is close to 100%. But in the real world, actual awareness could be relatively low, so the awareness variable helps desensitize the model (i.e., make it more similar to what would happen in the real world). A simulator lets you play “what if” games and explore hundreds of different combinations of category variables to see how total category sales and profits perform under different circumstances—and also explore how each brand’s performance can be improved.

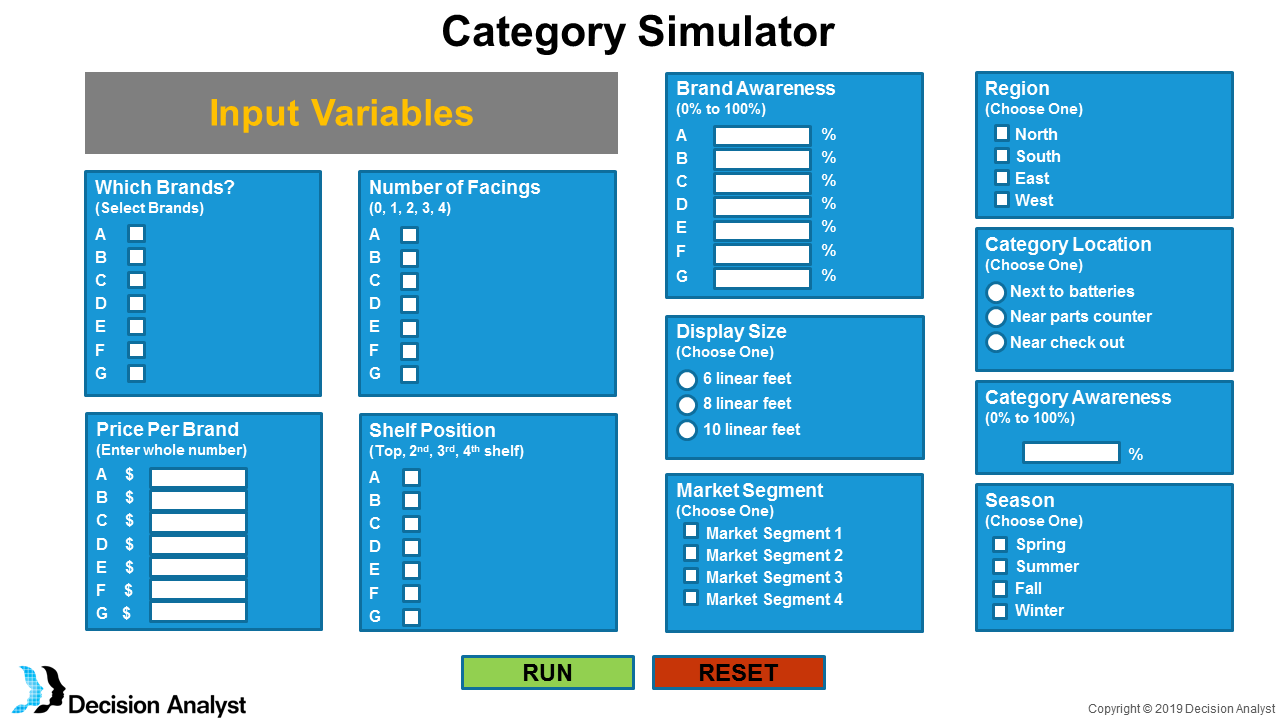

Here’s an illustration of what a simulator might look like, given the hypothetical example. This is the input screen, where the user can enter and change settings brand by brand. Brands are represented by capital letters A through G (i.e., seven brands). This screen allows the user to choose which brands to include in the category, to set prices, to choose number of facings, awareness level, and so on. Once all the variables are set, then the user hits the run button.

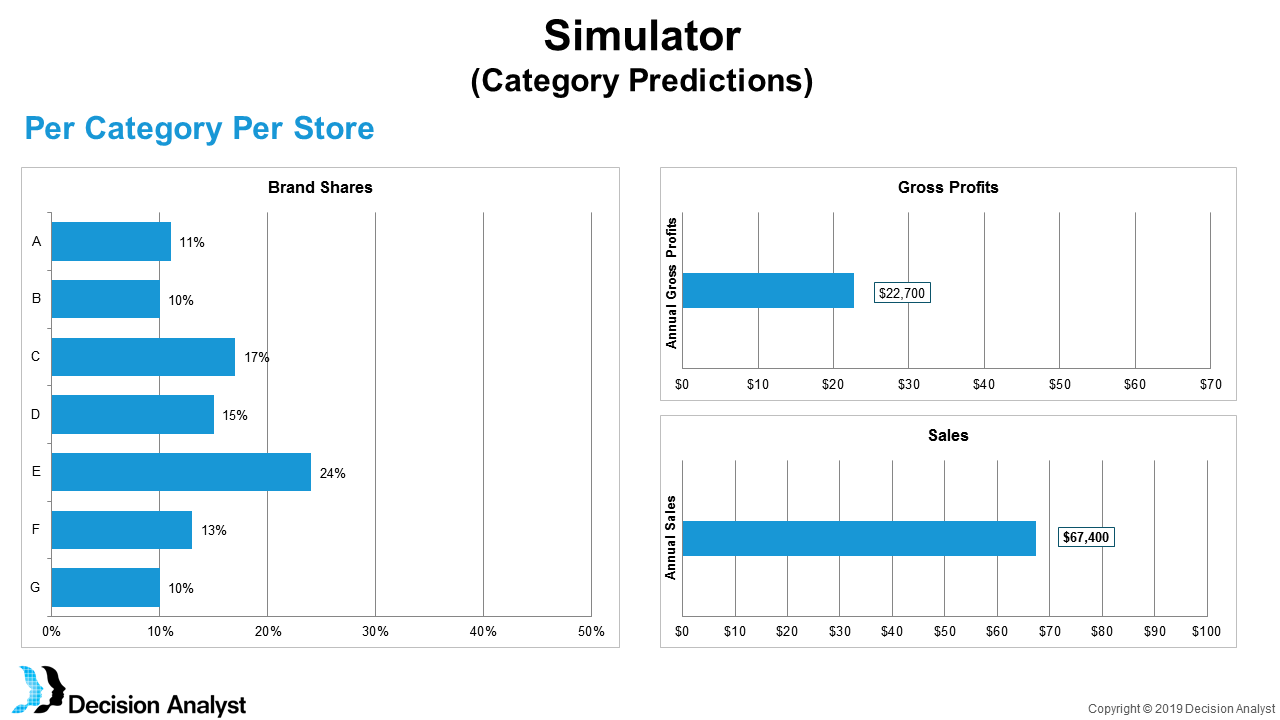

Here’s an example of how the output screen might look. For each combination of variables and settings on the input screen, the simulator (and the math it’s based on) calculates gross profits and sales per store for a given category, as well as each brand’s market share. It’s easy to see how valuable a tool like this could be. It’s also useful as a tool to determine the best way to respond to competitive challenges or pricing changes. Simulators can be used for at least two years, sometimes three, before market changes decay their accuracy.

The choice modeling equations and the simulator provide one set of solutions for one mythical retail store, but what if you have a chain of stores across the U.S. in different markets and different types of neighborhoods? The goal might be to optimize a category for each individual store throughout the chain. It’s possible to link the choice modeling variables to demographic, economic, and automotive data for the trade areas surrounding each store so that you can calculate an optimal solution for each retail store in the chain, or for subsets of stores with common demographic characteristics.

To map simulator results down to individual stores, you’ll need to survey a larger-sized sample, perhaps 3,000 or 4,000 target consumers rather than 1,500. The larger sample makes it possible to segment or cluster the consumers into similar groups, based on demographics, geography, and economics. You might end up with five to eight unique store segments, and optimal solutions would be run for each segment. Then (based on demographics, geography, and economics of the trade area around each store) the optimal solution for that type of neighborhood could be determined. This is a very powerful concept, in that it acknowledges that major target-audience differences exist across the units in a chain, and it strives to optimize long-term sales and profits on a store-by-store basis. It’s also extremely powerful for a specific brand to be able to go to a retailer and say, “Here are the 156 stores in which you should increase the shelf space devoted to my brand, because the demographics and economics around those stores are optimal for my brand.” In summary, choice modeling allows you to look at an extremely large number of possible solutions and to identify optimal or near-optimal solutions. Now you are ready for the final step: sales analysis.

Sales Analysis

Sales analysis works best after a category is already optimized with qualitative research and choice modeling. The big important improvements in the category have been identified. The optimal mix of brands is determined, and you have a good first approximation of optimal prices and display organization, perhaps down to the individual store. You probably already have good analytic tools in place for routine, day-to-day sales analysis. The goal of sales analysis is fine-tuning and tweaking; it’s generally not adequate for making the kinds of major changes we have discussed. You can’t optimize a category with sales-analysis tools; you can only make minor improvements. But sales analyses can be taken to a higher level.

If you really want to get serious about sales analysis, then building an analytic database is an essential first step. You already have your own sales data organized by store or geographic area and time period. To this you would add a wide range of government data, demographic and economic, down to the Census Block Group level. The Consumer Expenditures Survey (CES) and American Community Survey (ACS) are especially rich sources of high-quality data. There are many sources of commercial secondary data you could use to bolster your analytic database. If advertising plays a significant role in your business, then add in media spending by geographic area and media type. The database needs to be pure and clean (i.e., not a lot of missing data or dirty data). Now you are ready for some serious analysis.

With an accurate and up-to-date analytic database, you can begin to address a number of big strategic questions. What forces are driving growth or decline of your category (or categories)? What’s the future potential of a given category in a specific location? What’s the role of advertising in driving growth of a category or brand? What’s the optimal advertising media-spending level? What’s the optimal mix of advertising media to maximize sales of a category or brand? Many strategic questions can be addressed through sophisticated sales analyses, using econometric and other modeling techniques.

Magic Formula

To maximize sales of an automotive aftermarket category or maximize sales of a brand within a category, always start with qualitative research to identify the important variables and levels. Once you know what the important variables are, you can employ choice modeling techniques to look at 50,000 or 100,000 possible solutions and determine the optimal solution for your category or brand. Use sales analysis for the final tweaking and fine-tuning. You can take sales analysis to a much higher level by combining sales data with demographic, geographic, and economic data. Presto, you now have the magic formula to optimize sales and profits for a category or for a brand in the category.

About the Author

Jerry W. Thomas (jthomas@decisionanalyst.com) is President/CEO of Dallas-Fort Worth based Decision Analyst. He may be reached at 1-800-262-5974 or 1-817-640-6166.

Copyright © 2019 by Decision Analyst, Inc.

This article may not be copied, published, or used in any way without written permission of Decision Analyst.