U.S. Economic Recovery Slows

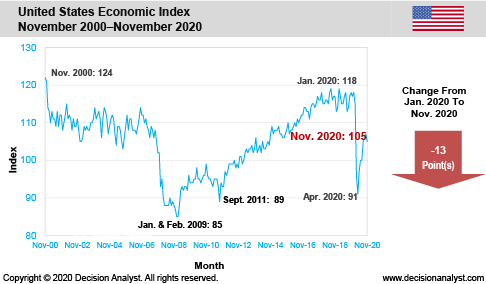

Arlington, Texas—The Decision Analyst U.S. Economic Index declined to 105 in November 2020, a decrease of 2 points from October. This 2 point decrease marked a turning point in the steady increases in the Economic Index since the sudden drop in March, April, and May earlier in the year. The November 2020 Economic Index remains well below the January 2020 time period (down by 13 points). Economic activity appeared to slow in November, as indicated by the decline of the Index and a rise in measured unemployment. The Index tends to be a leading indicator of future economic activity, as seen in the past-20-year history of the Index shown below.

“The U.S. Economic Index continues to signal economic growth, but at a slower pace for the balance of 2020 and into 2021, assuming no additional governmental stimulus for the economy. If colder weather and the reopening of businesses and schools continue to fuel a huge surge of COVID-19 cases, the U.S. economy will really struggle this winter. It’s possible that more government stimulus will be forthcoming, but it must come quickly to prevent additional softening of the U.S. economy. A growing risk factor is the likelihood of major business and corporate layoffs, as COVID-19 soars out of control. We are likely to see major layoff announcements by corporate America during the waning months of 2020 and the first quarter of 2021," said Jerry W. Thomas, President/CEO, Decision Analyst.

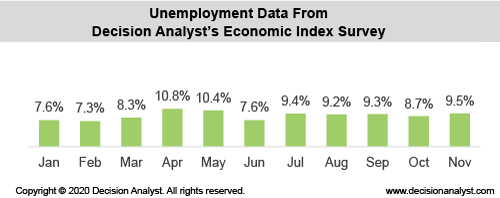

“In Decision Analyst’s Economic Index survey, U.S. adults are asked to self-classify their employment status. They have to say they are ‘unemployed but looking for a job’ to be counted as unemployed,” said Thomas. “The U.S. employment picture had been improving through the summer and start of fall, but took a downward turn in November. The U.S. unemployment rate remains at elevated levels, according to Decision Analyst’s tracking survey. In reviewing the Decision Analyst unemployment estimates, the November rate (9.5%) is the highest rate since May. Hidden within the data is a downtrend in full-time employment and large numbers of women dropping out of the labor force, probably to take care of children who are schooling at home,“ said Thomas.

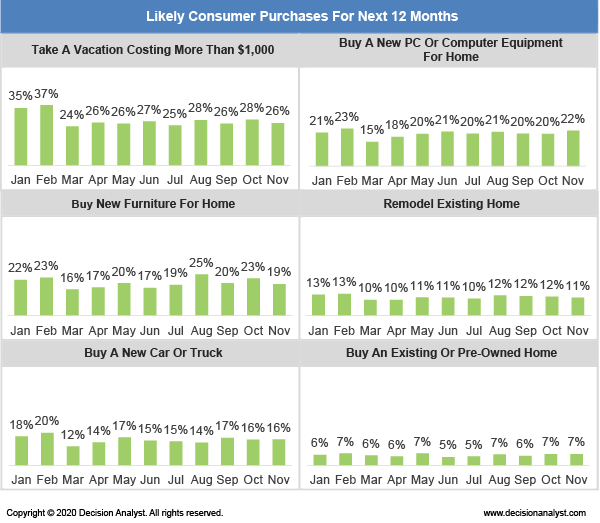

“Planned future purchases (see graphs below) continued, on average, to indicate that consumer spending (roughly 70% of the U.S. economy) is likely to remain reasonably stable into the first quarter of 2021. The graphs below show the percentage of U.S. households who say they are likely to make various types of purchases in the next 12 months.”

"Intentions to purchase new furniture for the home have slowed, while new computer equipment remains at elevated levels. Subdued travel and vacation plans indicate more pain and suffering in the hospitality industry (hotels, restaurants, entertainment venues, airlines, etc.). Car and truck sales have stabilized, while future sales of existing and new homes remain positive. All together, these graphs point to cautious consumers in the waning days of 2020 and the start of 2021,” said Thomas.

Methodology

The Decision Analyst Economic Index is based on a monthly online survey of several thousand households balanced by gender, age, and geography. The scientific survey is conducted in the last 10 days of each month. The Economic Index is calculated from 9 different economic measurements using a sophisticated econometric model. The result is a snapshot of coming economic activity in each country surveyed, as seen through the eyes of representative consumers living in the respective countries.

Decision Analyst conducts its concurrent economic surveys each month in Argentina, Brazil, Canada, Chile, Colombia, France, Germany, India, Italy, Mexico, Peru, the Russian Federation, Spain, and the United States. Whenever the Decision Analyst Economic Index is greater than 110, it tends to signal an expanding economy. An Index value of 90 to 110 suggests a no-growth or slow-growth economy, and near or below 90 generally indicates economic contraction. These guidelines vary by country, however.

About Decision Analyst

Decision Analyst (www.decisionanalyst.com) is a global marketing research and analytical consulting firm specializing in strategy research, new product development, advertising testing, and advanced modeling for marketing decision optimization. For over 40 years, the firm has delivered competitive advantage to clients throughout the world in consumer-packaged goods, telecommunications, retail, technology, medical, and automotive industries.

Media Contact

Cristi Allen

Publicity

Email: callen@decisionanalyst.com

Phone: 1-800-ANALYSIS (262-5974) or 1-817-640-6166

Address: 604 Avenue H East

Arlington, TX 76011

Library

Logos & Images

If you are doing a story on Decision Analyst or using any of our published data, news releases or articles, you must cite "Decision Analyst" as the source of the information.

If you use any of the charts or tables from the press releases or other published materials, please email Cristi Allen at callen@decisionanalyst.com to let us know which graphics you took and for what newspaper, magazine, or website it was used.