Consumer Foresight: Beyond The Pandemic, Into Economic Uncertainty

November 2022 Edition: Household Spending and 2022 Holiday Shopping Expectations

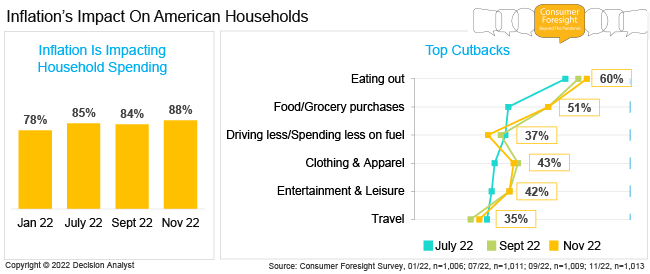

Inflation is impacting almost 9 in 10 households and is clearly the top consumer worry.

The vast majority of Americans say their household spending has been impacted by inflation. Food is the primary area in which people are tightening their budgets--both eating out and grocery buying.

Please feel free to email Bonnie Janzen or Felicia Rogers directly for additional information. Download our Consumer Foresight: Beyond The Pandemic (November 2022 Edition) Free.

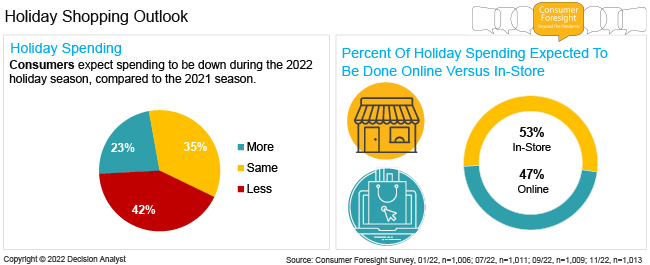

Holiday Shopping Outlook

Consumers expect spending to be down during the 2022 holiday season, compared to the 2021 season.

Holiday Retailer Mix and Gifts

Amazon, Walmart, and dollar stores will likely be the biggest winners in the Holiday 2022 shopping season.

About Decision Analyst

Decision Analyst (www.decisionanalyst.com) is a global marketing research and analytical consulting firm specializing in strategy research, new product development, advertising testing, and advanced modeling for marketing decision optimization. For over 40 years, the firm has delivered competitive advantage to clients throughout the world in consumer-packaged goods, telecommunications, retail, technology, medical, and automotive industries.

Emotional Health Through the Pandemic

Download a complimentary copy of the Consumer Foresight Beyond the Pandemic Report.

There are 5 reports available for download: January 2022: Financial Wellbeing Report, March 2022: Home Comfort, May 2022: Health & Wellness, July 2022: Consumer Packaged Goods, September 2022: Restaurants and November 2022: Retailers.

Contact

If you have any questions about the Consumer Foresight: Beyond The Pandemic please contact:

Felicia Rogers

Executive Vice President

Email: frogers@decisionanalyst.com

Phone: 1-817-640-6166

Methodology

The online surveys were conducted among adults aged 18+. Beginning in March 2020, a total of 22 waves have been completed among adults 18+ in the United States. Over all the waves, more than 12,000 consumers have been surveyed. Wave 1 consisted of over 1,500 completes across two online surveys. Waves 2-16 were conducted among approximately 500 U.S. adults each. In Waves 17-23, there were at least 1,000 completed surveys among U.S. adults.

Logos & Images

If you are doing a story on Decision Analyst or using any of our published data, news releases or articles, you must cite "Decision Analyst" as the source of the information.

If you use any of the charts or tables from the press releases or other published materials, please email Cristi Allen at callen@decisionanalyst.com to let us know which graphics you took and for what newspaper, magazine, or website it was used.