Decision Analyst's March Economic Index Reveals Recession Risks Are Rising

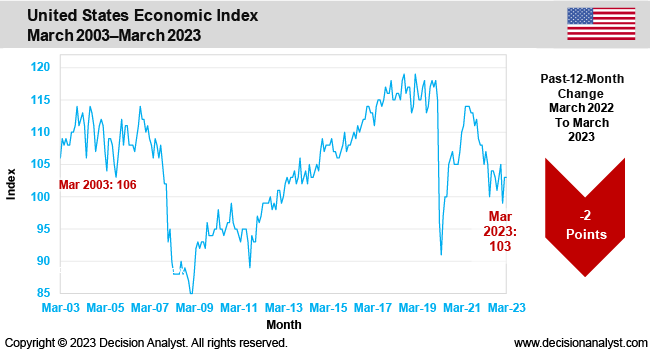

Arlington, Texas—The Decision Analyst U.S. Economic Index for March 2023 was 103, the same score as February 2023, and a decline of 2 points from March 2022 (105). The Economic Index has, on average, trended downward over the past 12 months. Since the U.S. Economic Index tends to be a leading indicator of the overall U.S. economy, the downward trend suggests a recession could begin during 2023, as is indicated in the past-20-year history of the Index below.

“The decline in the Economic Index over the past 12 months has been driven by high inflation rates, particularly in energy, food, and housing costs. Inflation reduces consumers’ purchasing power and tends to weaken the economy. Labor shortages in many sectors of the U.S. economy also increase the likelihood of recession. Lack of employees means goods cannot be produced and services cannot be rendered. COVID—and especially long COVID—continues to act as an economic drag, but this effect is waning. Many sectors of the U.S. economy (and the world economy) continue to be impaired by supply-chain disruptions, although these supply-chain issues are being resolved. Actions by an aggressive Federal Reserve are pushing interest rates higher in the U.S. and worldwide. These higher interest rates are beginning to slow economic activity,” said Jerry W. Thomas, President/CEO of Decision Analyst. “Another important factor is fragility of the banking system in the U.S. and corresponding risks of financial crises, as the money supply contracts and remote workers undermine the value of many types of commercial real estate in cities across the U.S. The probability of recession is high.”

Employment

The BLS’s Jobs Report for March 2023 indicated over 500,000 new jobs were created in the U.S. Decision Analyst tracks unemployment and the availability of jobs, as seen through the eyes of the average resident of the U.S. These charts suggest the labor market is continuing to cool down—and this also may be another signal that the overall economy is slowing down.

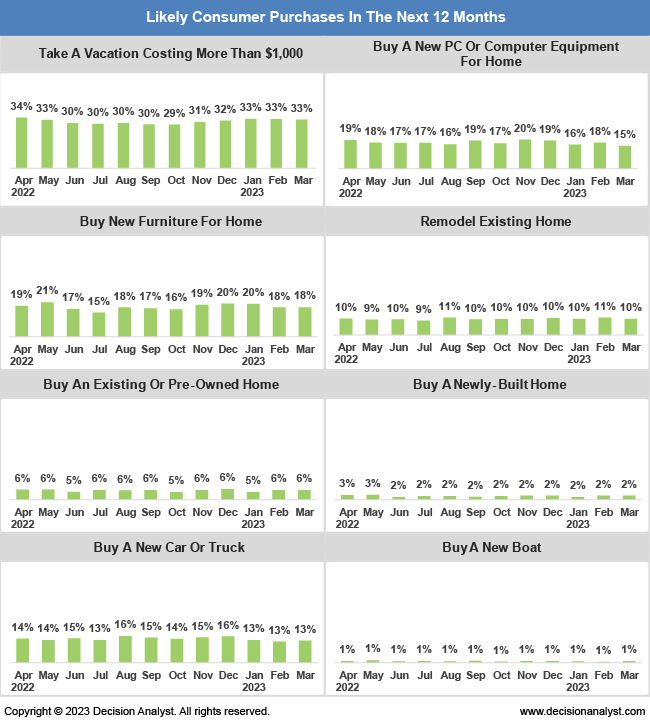

Future Purchase Intent

“Consumers’ planned future purchases (see graphs below) indicate that consumer spending (about 70% of the U.S. economy) is mostly flat to down slightly across various categories of spending. The graphs show the percentages of U.S. households that say they are likely to make various types of purchases in the next 12 months. A quick look at the trend charts reveals that consumers’ spending plans are either flat or down slightly in March 2023 across most of these major categories. The one exception is taking a vacation, where the trend line is clearly upwards,” said Thomas.

Methodology

The Decision Analyst Economic Index is based on a monthly online survey of several thousand households balanced by gender, age, and geography. The scientific survey is conducted in the last 10 days of each month. The Economic Index is calculated from 9 different economic measurements using a sophisticated econometric model. The result is a snapshot of coming economic activity in each country surveyed, as seen through the eyes of representative consumers living in the respective countries.

Decision Analyst conducts its concurrent economic surveys each month in Argentina, Brazil, Canada, Chile, Colombia, France, Germany, India, Italy, Mexico, Peru, the Russian Federation, Spain, and the United States. Whenever the Decision Analyst Economic Index is greater than 110, it tends to signal an expanding economy. An Index value of 90 to 110 suggests a no-growth or slow-growth economy, and near or below 90 generally indicates economic contraction. These guidelines vary by country, however.

About Decision Analyst

Decision Analyst (www.decisionanalyst.com) is a global marketing research and analytical consulting firm specializing in strategy research, new product development, advertising testing, and advanced modeling for marketing decision optimization. For over 40 years, the firm has delivered competitive advantage to clients throughout the world in consumer-packaged goods, telecommunications, retail, technology, medical, and automotive industries.

Media Contact

Cristi Allen

Publicity

Email: callen@decisionanalyst.com

Phone: 1-800-ANALYSIS (262-5974) or 1-817-640-6166

Address: 2670 E Lamar Blvd

Arlington, TX 76011

Library

Logos & Images

If you are doing a story on Decision Analyst or using any of our published data, news releases or articles, you must cite "Decision Analyst" as the source of the information.

If you use any of the charts or tables from the press releases or other published materials, please email Cristi Allen at callen@decisionanalyst.com to let us know which graphics you took and for what newspaper, magazine, or website it was used.